Donald Trump’s imposition of tariffs on trading partners is a contentious issue with significant economic implications. The central argument is that Trump may not have fully grasped the potential for these tariffs to trigger a market crash. This essay explores why Trump might have underestimated the risks associated with his tariff policies.

Tariffs are taxes imposed on imported goods and services. They are typically implemented to protect domestic industries by making imports more expensive, thereby encouraging consumers to buy locally produced goods8. While tariffs can provide short-term benefits to specific sectors, they also carry the risk of triggering retaliatory measures from trading partners, leading to trade wars that can harm the global economy26.

Trump has stated that tariffs will boost U.S. manufacturing, protect jobs, and raise tax revenue8. He views tariffs as a tool to address trade imbalances and to pressure other countries to negotiate more favorable trade deals with the U.S1.

Several factors may explain why Trump underestimated the potential for his tariffs to trigger a market crash:

- : Trump’s approach to trade policy may be driven by a focus on short-term gains rather than long-term economic stability4. He may have been more concerned with fulfilling campaign promises and demonstrating a tough stance on trade than with the potential negative consequences of his actions.

- : Trump may lack a deep understanding of the complexities of international trade and the interconnectedness of the global economy2. He may not have fully appreciated how tariffs could disrupt supply chains, increase costs for businesses and consumers, and trigger retaliatory measures from other countries.

- : Trump may have believed that his negotiation skills could mitigate the risks associated with tariffs. He may have assumed that he could use the threat of tariffs to extract concessions from trading partners without causing a full-blown trade war.

- : Trump’s trade policies may have been influenced by advisors with protectionist views who downplayed the risks of tariffs and emphasized their potential benefits to domestic industries.

Trump’s tariffs have had several negative economic consequences:

- : Tariffs increase the cost of imported goods, which can lead to higher prices for consumers and businesses17. This can reduce consumer purchasing power and harm industries that rely on imported inputs.

- : Tariffs can disrupt global supply chains, making it more difficult for businesses to source the goods and materials they need to operate3. This can lead to production delays, reduced efficiency, and higher costs.

- : Trump’s tariffs have triggered retaliatory measures from trading partners, leading to trade wars that harm U.S. exports and reduce economic growth36.

- : Tariffs can lead to job displacement in industries that rely on exports or imported inputs1.

- : The combination of increased costs, disrupted supply chains, and retaliatory measures can reduce overall economic growth15.

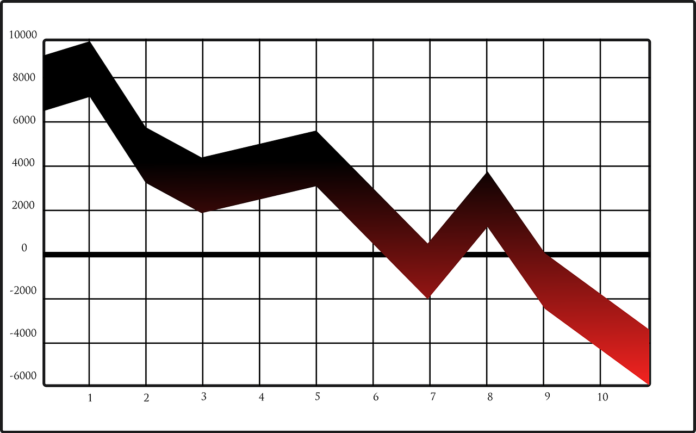

There is evidence that Trump’s tariffs have contributed to market instability. For example, U.S. stock markets experienced significant fluctuations following the imposition of tariffs on Canada and Mexico26. The Dow Jones Industrial Average fell sharply, and the VIX, a measure of market volatility, soared to its highest level of the year2.

It is important to note that there are alternative perspectives on Trump’s trade policies. Some argue that tariffs can be effective in addressing trade imbalances and protecting domestic industries. They may also argue that the short-term economic costs of tariffs are outweighed by the long-term benefits of a more balanced and competitive trading system.

In conclusion, there are several reasons why Trump may have underestimated the potential for his tariffs to trigger a market crash. These include a focus on short-term gains, a lack of understanding of economic complexity, overconfidence in negotiation tactics, and the influence of protectionist advisors. The economic consequences of Trump’s tariffs have included increased costs for consumers and businesses, disruption of supply chains, retaliatory measures from trading partners, job displacement, and reduced economic growth. While there are alternative perspectives on Trump’s trade policies, the evidence suggests that his tariffs have contributed to market instability and have had negative economic consequences.

By George Prince

Citations:

- https://www.supplychainbrain.

com/blogs/1-think-tank/post/ 41332-the-economic-and- geopolitical-consequences-of- trumps-tariffs - https://www.cnn.com/2025/03/

04/economy/global-markets- trump-tariffs/index.html - https://www.piie.com/research/

piie-charts/2025/trumps- tariffs-canada-mexico-and- china-would-cost-typical-us- household - https://www.nytimes.com/2025/

03/06/us/politics/tariffs- trump-mexico-canada-stock- market.html - https://taxfoundation.org/

research/all/federal/trump- tariffs-trade-war/ - https://www.npr.org/2025/03/

04/nx-s1-5317515/u-s-stock- markets-plunge-trump-tariffs- canada-mexico-china - https://www.bbc.com/news/

articles/crrd7gpvw5po - https://www.bbc.com/news/

articles/cn93e12rypgo - https://www.oxfordeconomics.

com/resource/trumps-tariffs- pose-uneven-subnational-risks- across-the-eu/